May 14, 2024

The take, make, waste cycle of the fashion industry continues to accelerate even as the effects of climate change become more evident. It’s a fact that’s putting both the planet and profits in jeopardy.

Last year, consumers purchased approximately 102 million tons of clothing and footwear, representing a 60 percent increase over 2022, according to McKinsey & Company. What’s worse? Still far too much of that clothing is made from virgin raw materials, not to mention inputs derived from fossil fuels.

This pace is putting the industry further and further out of reach of turning the tide on global warming. In addition to retraining consumers to buy less, smarter and better, fashion must find a way to decouple growth from the use of conventional fibers.

“Next Gen is the future of fashion!” said Nicole Rycroft, founder and executive director of Canopy. “Continued reliance on virgin fiber materials such as viscose made from forest fiber brings significant reputational and legal risk to brands. Additionally, we’re already seeing the climate crisis disrupt virgin supply chains and it is only going to intensify.”

Through CanopyStyle, the environmental non-profit works with brands to champion next gen textiles, which Rycroft defines as man-made cellulosic fiber alternatives derived from industrial food waste, agricultural residues and discarded clothing. “All produce excellent quality products (‘stronger than wood and finer than silk’), bring compelling environmental benefits (think, 5x less impact on biodiversity, 4 tons less carbon per ton of product compared to virgin wood…) and present significant marketing opportunities to brands,” she said.

Textile Exchange is committed to helping fashion reduce the extraction of fossil fuels through the uptake of preferred materials, which are defined as either sustainably-sourced renewable or recycled.

But Beth Jensen, senior director of climate and nature impact for the organization, noted even a dramatic pivot to preferred won’t enable the industry to meet its targeted 45 percent greenhouse gas emissions reduction related to the raw materials and fibers by 2030. “The bigger picture here is that substitution of materials is one lever that we need to pull, but we can't just keep substituting materials at the same rate of production that's currently occurring. [We also must] reduce the amount of new materials we're producing overall as an industry,” she said.

Making these changes comes with a raft of challenges that don’t end at developing and scaling less impactful fibers. Jensen said the industry must also rejigger the current infrastructure that’s designed to handle conventional inputs. And that alone is no easy task. “For companies to work collaboratively with all of the different partners throughout the supply chain to understand how to integrate a new fiber or material, to get that buy-in and to get the process adjustments made throughout all of the different steps in the supply chain can be a real challenge,” she said.

As with any large-scale overhaul, the price tag is hefty. “We estimate that $9 to $11 billion is needed to build the new infrastructure that will ensure 50 percent of viscose is coming from textile waste, agricultural residues, and other Next Gen sources by 2030,” Rycroft stated.

Rycroft is already noticing investors consciously opting to underwrite low-impact alternatives but she said, public funding will also be necessary. “Government feed-in tariffs and transition funds helped scale renewable energy solutions such as solar and wind energy over the past 10 years,” she said. “Those support mechanisms are currently not available to circular Next Gen materials but they need to be to enable new-to-market Next Gen innovators successfully navigate the commercialization stage.”

Though this type of financial support isn’t on the horizon, regulation is. As a result, Jensen is seeing an increasing number of brands employing lifecycle assessment managers to help them verify impact data to aid in decision making and to weigh it against variables like performance and durability. This need to produce environmentally-responsible products and processes that are also fashionable and functional will continue, she said. “This is an industry that’s primarily been built by creatives and artists. Sustainability is scientific. It's technical science. And so, what you're seeing now is we're trying to marry these two sides of expertise.”

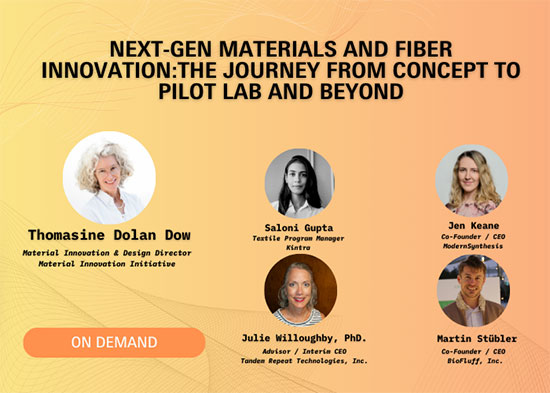

Textile Talks On Demand: Next Gen Materials

Texworld’s Innovation in Plant-based Materials panel is now available to watch on demand. Click through to learn how companies are developing bio-based solutions to material production and end of life—two of the most impactful stages in the apparel lifecycle.

The discussion, led by moderator Thomasine Dolan Dow, Materials Innovation & Design Director at Material Innovation Initiative, explores how brands like Reformation, Stella McCartney and Ganni are ushering in a new wave of material science. The speakers—who included Saloni Gupta, Textile Program Manager, Kintra Fibers; Julie Willoughby, PhD., Advisor/Interim CEO, Tandem Repeat Technology; Jen Keane, co-founder/CEO, Modern Synthesis; and Martin Stubler, co-founder/CEO, Biofluff, Inc.—shared their experiences related to scaling production, absorbing dyes in bio-based solutions, and nailing performance.

The panel also spoke to commercialization and what it takes to co-develop polymers and fibers with brands, a process that comes with unique challenges.

Keane said most fashion brands are used to “buying off the shelf and making incremental developments. So when you introduce something that's completely new to these brands, a lot of times there isn't the structure for embedding these new technologies into collections.” However her experience working with Ganni and its Fabrics for the Future project enabled Modern Synthesis to work together seamlessly on getting their innovation into product. “These relationships are so critical because the brands are the product experts. So if you're making a handbag or you're making a shoe, the material requirements are very different… And a lot of the conversations are about what are the right standards to be holding these materials to? What do they have to do in the product?” she said.

The Major Influences Driving Fall/Winter 2025

Texworld shares the leading design trends heading into Fall/Winter 2025, as presented at the January NYC show. The overarching concept is Transcendence, as it challenges traditional notions of fashion and opens new possibilities for self-expression and creativity. Think: reaching higher states of being, blurring the boundaries between humans and machines and the queering human-ness.

Below are some key ways that Transcendence will be represented in the seasons ahead:

- Brutalism borrows from the architectural style characterized by bold, geometric forms to produce structural silhouettes, minimalist aesthetics and monochromatic color schemes.

- Eco-Romanticism welcomes an appreciation for nature’s beauty and a more thoughtful and responsible approach for fashion design and the people who create it.

- Fusionism celebrates eclecticism through the blending of different cultural, historical, and aesthetic elements. By embracing diversity, it encourages a cohesive and individualistic look.

- With Scientism science and tech come first, particularly through the use of material innovation in the move toward greater sustainability. Ornate embellishments take a back seat to minimalist designs.

Register now to experience our Texworld Trend Showcase and much more on July 16 - 18 at the Javits Center, NYC!

‘Econogy’ Highlights Connection Between Sustainability & Profitability

Econogy is a new phrase coined by Messe Frankfurt’s Texpertise Network to convey that doing good for the planet is also a boon for business. And it turns out, it’s a mindset that Texworld exhibitors have already taken to heart. Increasingly, suppliers at the show are showcasing the ways in which they’re innovating to make less impactful products that are also good for the bottom line.

Texworld show director Jennifer Bacon has witnessed the rise of econogy as a concept over the last few years as the industry has mobilized to reduce the impact of the climate crisis. Here, Bacon shares how companies are approaching the challenge, how Texworld is facilitating collaboration and education on the topic, and what more still needs to be done.

Q: How would you characterize the apparel and home goods industries’ willingness to adopt less impactful materials?

JB: At Texworld, we see the concept of ‘econogy’ in action through the innovative approaches and practices embraced by our exhibitors. Many exhibitors are increasingly integrating sustainable materials, processes, and business models into their operations. They understand that prioritizing sustainability isn't just an ethical choice but also a strategic one. By adopting eco-friendly practices, Texworld exhibitors are not only reducing their environmental footprint but also enhancing their competitiveness and long-term viability in the market.

Q: How does Texworld support the industry’s adoption of environmentally-friendly materials and practices that are both good and profitable?

JB: Texworld actively promotes the idea that environmentally friendly practices are not only beneficial for the planet but also essential for sustainable business growth. Through various initiatives, such as our Econogy-focused events and lectures, we provide exhibitors and attendees with valuable insights and resources on implementing eco-friendly practices in their operations. We showcase success stories of businesses that have embraced sustainability and achieved tangible benefits, including cost savings, enhanced brand reputation and access to new markets. By highlighting these examples and facilitating discussions on sustainable business strategies, Texworld encourages industry stakeholders to recognize that environmentally friendly practices can indeed drive business success.

Q. How is consumer demand playing into how Texworld exhibitors are evolving their businesses?

JB: As consumers become more conscious of sustainability issues, demand for products made from eco-friendly materials, such as organic cotton, recycled polyester and bamboo and other plant-based materials is on the rise. Many leading brands and retailers are responding to this shift by incorporating sustainable materials into their product lines and implementing responsible sourcing practices. While progress has been made, there's still room for improvement, particularly in terms of scalability, cost-effectiveness and supply chain transparency.

Q: What will it take to accelerate the pace at which fashion and home innovate and evolve?

JB: Accelerating the adoption of more responsible practices in the apparel and home goods industries will require collective action and commitment from all stakeholders. Firstly, there needs to be greater collaboration and knowledge-sharing within the industry to identify and implement best practices for sustainability. This includes sharing insights on sustainable materials, technologies, and supply chain management strategies.

Additionally, policymakers play a crucial role in incentivizing and regulating sustainable practices through policies, incentives, and standards that promote eco-friendly alternatives and hold businesses accountable for their environmental impact.

Consumers also have a significant role to play by demanding transparency and sustainability from brands and making informed purchasing decisions.

Ultimately, achieving widespread adoption of responsible practices will require a concerted effort from businesses, governments, NGOs and consumers working together toward a more sustainable future.

What We’re Reading

UFLPA: Intentions Vs. Impact

The effectiveness and enforcement of the Uyghur Forced Labor Prevention Act is under the microscope as fashion brands continue to grapple with compliance, according to an article in Kingspin Quarterly. While the stated purpose of the law is to stop goods made with forced labor from entering the country, its legacy could be traceability finally taking hold as table stakes. On the other hand, read the article to learn how the UFLPA could be undermining the industry’s move toward circularity.

Foreign Fast Fashion Firms Facing Headwinds Over De Minimis, Forced Labor

The U.S. could be closing the de minimis loophole but it might be too late to stem the tide of inexpensive goods surging in from China. A recent article in Sourcing Journal lays out the reasons why lawmakers want to change or eliminate the regulation that allows shipments under $800 to enter the country duty free. Find out how companies like Shein and Temu are maneuvering to set up operations to ease their reliance on de minimis, including partnering with logistics firms and leaning into free trade zones.

On-Demand Manufacturing Provides a Blueprint for the Wasteful Fashion Industry

Fashion’s “made to stock” operations might be the culprit behind a slew of woes from revenue declines to greenhouse gas emissions. Valerie Moatti, a professor at the ESCP Business School, argues that small-batch on-demand manufacturing is the answer but it will take a shift in both technology and culture. Read The Fashion Law article to learn how companies like UnSpun are leaning into 3D weaving and Alohas are opting for small runs.